Capital Shield

Home > Capital Shield

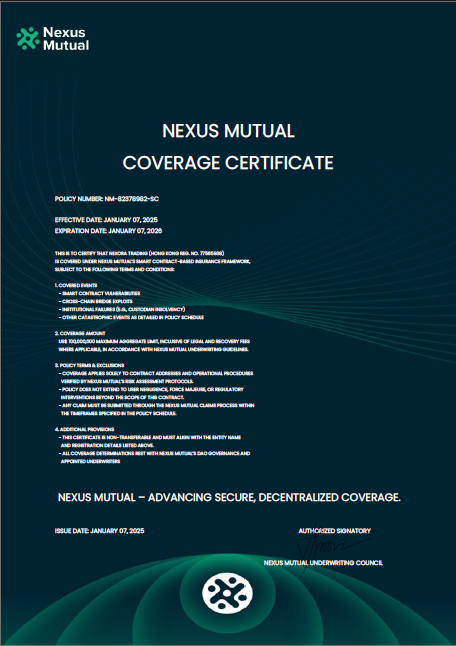

Nexora Protect: Uncompromising Security for Your Investments

Safeguarding Your Capital Through Innovation & Resilience

At Nexora, safeguarding our investors’ capital is more than just a promise—it’s a fundamental pillar of our platform’s design. Nexora Protect encapsulates this commitment, integrating robust insurance coverage, strategic partnerships, and thorough auditing processes to ensure that your financial journey remains as secure as it is innovative.

Events Covered by Our Insurance

-

01

Legislative Transformations: Sudden regulatory shifts or financial law changes that drastically affect the value or management of your investments.

-

02

Asset Nationalization: Government actions, including confiscation or forced nationalization, jeopardizing the underlying assets in which your funds are invested.

-

03

Systemic Institutional Failures: Unexpected collapses of critical financial intermediaries or partners—banks, custodians, or DeFi protocols—leading to significant disruptions in capital flows.

-

04

Widespread Economic or Political Turbulence: Large-scale market crashes, political unrest, or conflicts that expose your investments to extreme volatility.

-

05

Cross-Chain Network Compromises: Disruptions or exploits at the infrastructure level—such as major flaws in cross-chain bridges—resulting in potential loss of funds.

-

06

Force Majeure Incidents: Catastrophic events like natural disasters or cyberattacks that fall outside normal operating conditions yet severely affect investment stability.

Insured Capital: Five Key Pillars of Protection

1. Scope & Transparency

Our coverage spans multiple asset classes—from stocks and

bonds to select digital tokens—united under one secure

umbrella. Clear policy documents outline all inclusions

and exclusions so you always know where you stand.

2. Institutional-Grade Backing

Nexora’s deep-rooted partnerships with global financial

giants like MUFG and BNY Mellon

reinforce our $140 million insurance reserve, merging

tried-and-true banking standards with next-generation

blockchain innovation.

3. Multi-Layered Audits & Safeguards

We partner with Quantstamp for rigorous

contract audits and rely on Immunefi’s

bug bounty protocols to detect vulnerabilities proactively.

This synergy of expertise upholds our insurance framework’s

efficacy and stability.

4. Adaptive Coverage Period

Our insurance policy is designed to evolve with regulatory

landscapes and market developments. Automatic renewal ensures

continuous coverage unless otherwise modified by either party.

5. Holistic Investor Confidence

Nexora Protect transcends standard insurance, acting as a

strategic cornerstone for trust. By aligning comprehensive

coverage, auditing expertise, and institutional credibility,

we empower both new and seasoned investors to embrace

AI-driven finance with peace of mind.